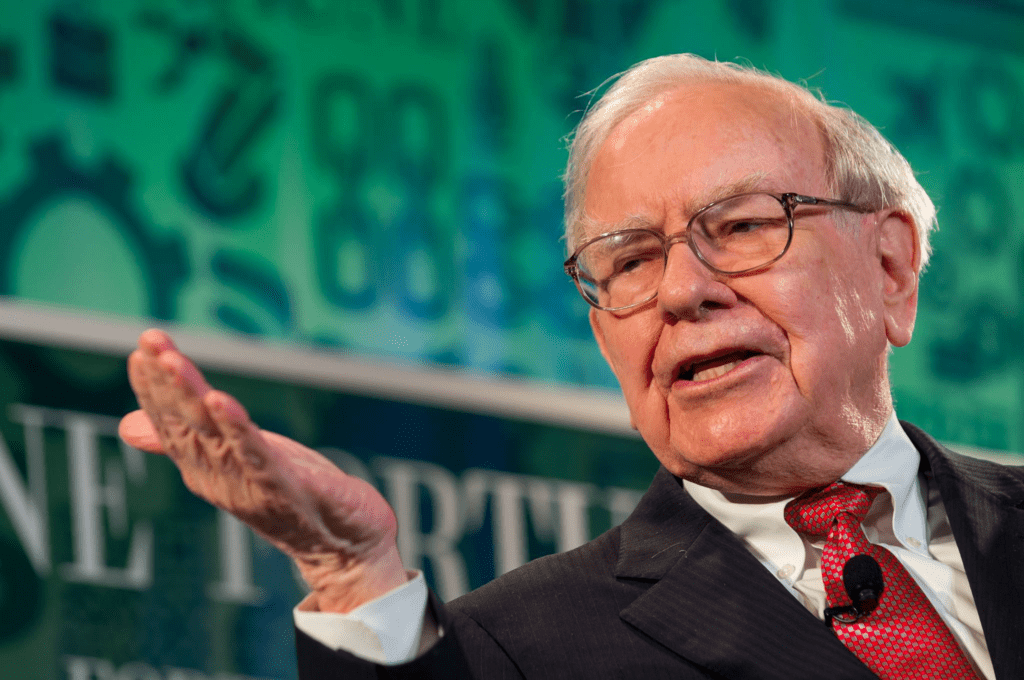

This year, betting against Warren Buffett’s Berkshire Hathaway could be profitable, as reduced buybacks and stock purchases, weaker consumer spending, and pressure on Geico threaten to drag down the stock price of the conglomerate.

This week, Meyer Shields, an equity analyst at Keefe, Bruyette & Woods who follows Berkshire, made this case in a research note. He added Berkshire stock to KBW’s list of the best shorting opportunities for the remainder of 2022. It has decreased by only 7% this year, compared to the S&P 500’s drop of 17%.

Cutting back on purchases

Buffett and his team spent only $3.2 billion and $1 billion on share repurchases in the first and second quarters of this year, respectively. In contrast, they invested $52 billion in buybacks during the years 2020 and 2021.

The investor explained at Berkshire’s annual shareholder meeting in April that, after struggling to find bargains during the pandemic, this year they were able to find better investments than their own stock.

In fact, Berkshire invested $41 billion in net stock purchases during the first quarter. However, it spent only $4 billion on a net basis during the second quarter, indicating that it identified fewer opportunities during the period.

According to Shields, the decline in Berkshire’s buybacks and stock purchases during the previous quarter may continue, given the company’s conservative investment strategy and the recent increase in equity prices. He argued that investors have not sufficiently factored this into their expectations, and as a result, Berkshire stock could decline.

Sluggish consumer demand

Berkshire’s subsidiaries include insurers, railroads, utilities, manufacturers, and retailers, making it a microcosm of the American economy. Shields estimated in his note that approximately 80% of the company’s operating income is generated by consumer-sensitive businesses.

As a result, the analyst cautioned that Berkshire could be severely impacted by a decline in consumer spending due to inflation, rising interest rates, and the possibility of a recession. Indeed, Berkshire cited inflation, weak demand, supply disruptions, and shortages of raw materials and workers as headwinds to its second-quarter earnings.

Unrest at Geico

Geico went from a profit of $626 million in the second quarter of 2021 to a loss of $487 million in the most recent quarter. Higher used-vehicle prices and auto-parts shortages drove up the cost of paying out claims during the period, as explained by the automobile insurer.

This year, according to Shields, Geico’s increased costs of labor and auto parts, along with higher interest rates, will likely result in sluggish sales growth and margin pressure. He also stated that increased marketing expenditures centered on the brand’s gecko mascot would exacerbate the problem.

Short-term suffering, long-term profit

Shields concluded that the likelihood of Berkshire reducing its stock purchases and buybacks, its businesses’ waning consumer demand, and Geico’s difficulties portend poorly for its stock this year.

However, the analyst emphasized that he remained long-term bullish on Berkshire. He has a “market perform” rating on the stock and a price target of $535,000 for its “A” shares, which represents a 27% increase from the stock’s current price.

Don’t forget to follow us on Facebook | Instagram | Twitter | LinkedIn to get the latest updates from Cape Town Tribune