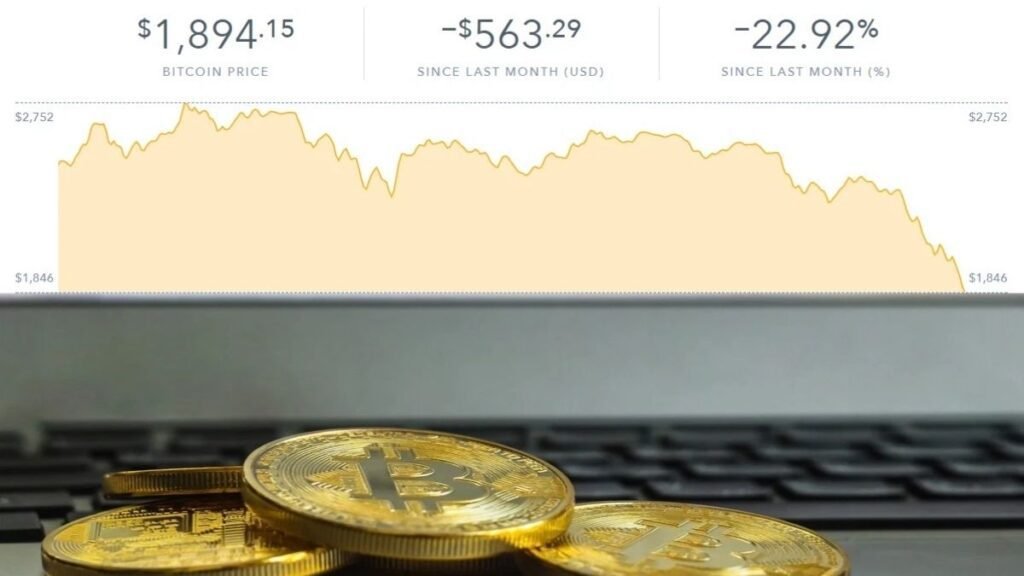

Following the China Banking Affiliation’s admonition against computerized monetary standards from part banks, the cost of bitcoin fell by up to 29 percent on Monday. Other computerized monetary forms have additionally existed.

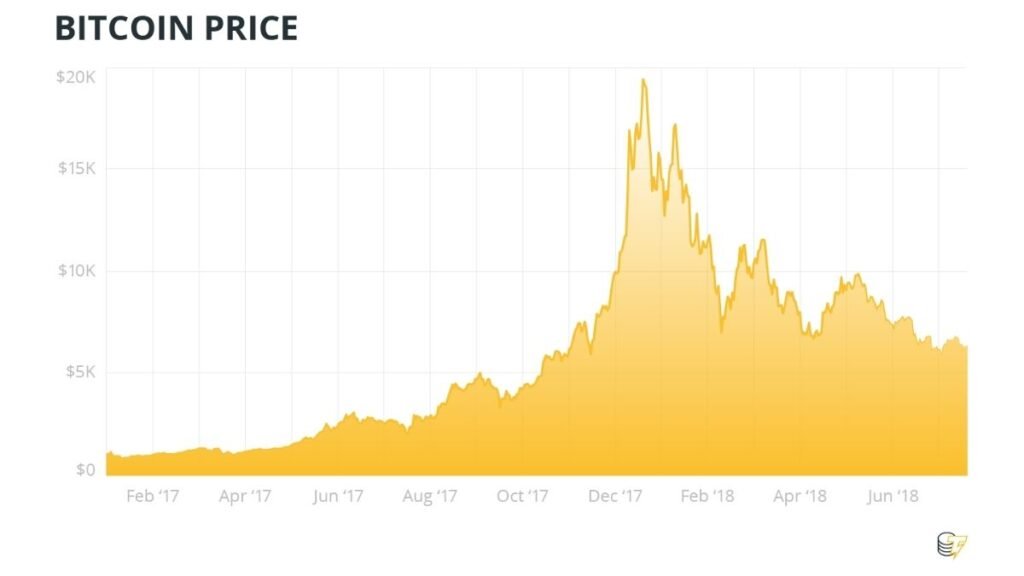

Bitcoin’s instability was on full presentation, with a drop to under 10% in early evening time exchanging. Since April 13, when it topped at more than $64,606 per coin, Bitcoin has lost generally 40% of its worth.

Before Wednesday, the decay was powered by worries about fixing guideline of computerized monetary standards, just as Tesla’s refusal to acknowledge advanced monetary standards as installment for vehicles. In 2021, the cost will have ascended by around 31% from the earlier year, and by almost 300% from the earlier year.

What happened to the price?

On Wednesday, an assertion posted on the Chinese Financial Affiliation’s site said monetary establishments ought to “unfalteringly refrain” from offering types of assistance utilizing advanced monetary forms due to their unpredictability.

Essentially every digital money fell after the business gathering’s assertion. Bitcoin drooped to $30,202 prior to recuperating to $38,038, down 12% on the day, as per Coindesk. Most digital currencies lost between 7% and 22 percent of their worth and portions of Coinbase dropped 5.4 percent .

Bitcoin’s worth can vary by a huge number of dollars very quickly. Bitcoin shut just shy of $30,000 on the last exchanging day of 2020. It was almost $65,000 in mid-April. Following that, the value rose with a couple of huge changes prior to diving drastically a week ago.

How Bitcoin works

Bitcoin is a disconnected computerized cash that permits clients to go through cash secretly. Clients “mined” coins by giving registering ability to confirm the exchanges of different clients. You are repaid in Bitcoins. The coins can be bought and sold on trades for US dollars or different monetary standards. A few organizations, just as various monetary foundations, acknowledge Bitcoin as installment, however Bitcoin’s overall worthiness stays restricted.

Bitcoins are essentially PC code lines that are carefully endorsed as they are moved from one proprietor to another. Since unknown exchanges were conceivable, the cash filled in ubiquity among libertarians, tech aficionados, examiners, and crooks.

Bitcoins should be put away in a computerized wallet, which can be traded online through a particular programming trade like Coinbase or disconnected on a hard drive. As per Coinbase, there are around 18.7 million Bitcoins available for use, with just 21 million at any point made. The justification this is obscure, similar to the area of all bitcoins.

Don’t forget to follow us on twitter @towntribune